Hey Risers

This is our first issue of 2026 and the beginning of a year that I expect will be pivotal for the Indo-European partnership. Thank you for being part of India Rising. It’s great to have you here.

Here are the topics of our first issue this year:

India’s economic growth: data signals continuing momentum.

India’s renewable energy push of 2025: More to come.

Novartis and Roche make India key hub for technological development: What other European companies can learn from it.

And much more.

Learned something? Help someone else and share India Rising with your friends, family and co-workers. Let’s grow our community together and thank you for supporting the Indo-European partnership.

Got feedback? Just hit reply, I’d love to hear from you!

Number of the Week

USD 4.18 Trillion

India’s GDP reached USD 4.18 Trillion in 2025, overtaking Japan as the 4th largest economy.

Rise of the Week: The Confirmation of India’s Economic Growth

After a strong second half of 2025 with 8.2% GDP growth rates year-over-year in the last reported quarter, India is now officially the 4th largest economy. Financial institutions expect India to remain the fastest growing economy for the foreseeable future, and the reasons why clearly indicate the potential that European businesses, in my opinion, still largely underestimate.

Partially generated with Google Gemini

Just before the end of the year, news outlets such as Deutsche Welle shared that India’s economy as per total GDP in USD is now larger than Japan’s thanks to accelerating economic growth in the last quarters and strong domestic demand. This is against economic headwinds and US-imposed tariffs, as well as the Rupee’s relative weakness against the USD, which makes this growth, calculated in USD terms, even more impressive compared to Japan's stable currency environment in 2025.

Source: Google Finance (2026)

The data indicates this momentum to last:

GDP 2025: USD 4.18 trillion

GDP 2030: USD 7.3 trillion (projected)

Growth y-o-y in last quarter (Q2 FY 2025-26): 8.2%

In its “Year Ahead” outlook report and as reported by The Economic Times, the Swiss bank UBS highlights India as one of the most resilient growth stories among major economies. While global markets face uncertainty, India’s large domestic market and strong internal drivers act as a buffer against external headwinds and tighter global financial conditions.

UBS highlights several reasons for India’s resilience:

Internal Demand: Robust domestic consumption and a steady infrastructure CapEx cycle provide a buffer against global headwinds.

Macro Stability: Moderating inflation and policy consistency are supporting real income growth and corporate earnings visibility.

Structural Reforms: Increased economic formalization and productivity gains from recent reforms have strengthened the country’s growth foundation.

Sectoral Strength: A healthy financial sector with strong credit growth and a thriving industrial/tech landscape are driving momentum.

Global Supply Chains: India is a primary beneficiary of "China + 1" strategies as global manufacturing shifts towards diversified hubs.

Market Depth: A strong local investor base provides a "defensive appeal" insulating Indian equities from volatile global capital flows.

European companies could substantially profit from India’s stable and growing domestic market, and offset declining revenues in other markets globally. And I think this requires to be initiated now in order to be able to participate in India’s growth and secure a stable anchor against the volatile markets today.

Sources: Deutsche Welle, The Economic Times, Google Finance

What Else is Rising?

India’s Renewable Energy Push in 2025

Energy capacity is a key signal for economic stability and development. Building up such infrastructure requires substantial investments, governmental support and strategic targets. Latest numbers show that 2025 has been a successful year for India’s efforts in addressing the increasing energy demand with renewable energy. Reaching Paris Agreement goals early also indicate the trajectory of India’s larger solar ecosystem.

Here’s an overview of India’s renewable energy push in 2025 according to the Times of India:

Total Capacity (GW) | Share of Total Capacity | Addition in 2025 (GW) | |

|---|---|---|---|

a. Total energy capacity (fossil and non-fossil) | 509.64 | N/A | N/A |

b. Thereof non-fossil energy | 262.74 | 51.55% | Not available |

b1. Thereof renewable energy | 253.96 | 49.8% | +44.5 |

b1.1. Thereof solar energy | 132.85 | 26.1% | +35 |

b1.2. Thereof wind energy | 53.99 | 10.6% | +5.82 |

India therefore reached its Paris Agreement targets five years earlier than scheduled and is now ranked

Third in solar energy capacity

Fourth in wind power capacity, and

Fourth fore renewable energy capacity overall.

While capacity is not all (see India Rising issues 5 and 33), it still is proof of India’s intend to become less reliable on fossil fuels overall. Targets were also reached earlier than various think tanks anticipated and might require a closer and more detailed evaluation.

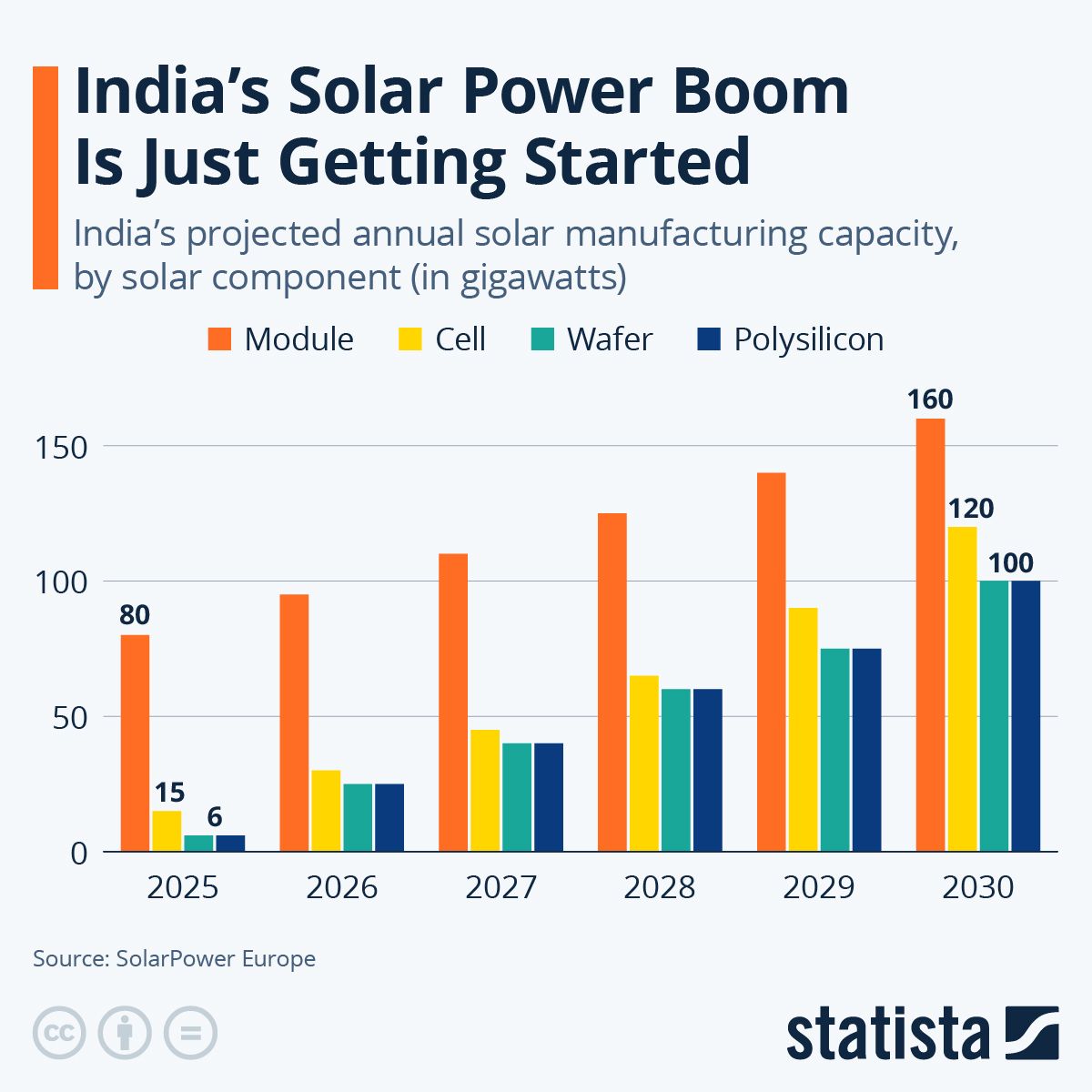

The direction however is clear: India wants and needs to become less reliable on fossil fuels as well as foreign solar products. This is not only being addressed by an increasing renewable energy capacity, but domestic solar manufacturing ecosystems as well. According to SolarPower Europe and as shared by Statista, India’s photovoltaic module manufacturing capacity is expected to double by 2030 to 160 GW from 80 GW today, alongside cell, wafer and polysilicon components:

Source: Statista (2025)

European capital and businesses move to India to contribute and benefit from this ecosystem. Copenhagen based AP Moller Capital, the global leader in shipping and owner of Maersk, announced to invest in a 900 MW clean energy product by Rays Power Infra, a Mumbai based renewable energy developer.

I’ve covered the renewable energy sector, Indo-European collaborations and investments in several issue before. The latest data once again confirms that European businesses need to take action in order to participate in one of the largest infrastructure build outs globally today.

Sources: Times of India, Statista, SolarPower Europe

Novartis and Roche Make India Key Hub for Technological Development

India’s Global Capability Centres (GCCs) have seen tremendous momentum over the past year throughout all sectors. The two Swiss life sciences leaders Roche and Novartis are no exception, as their leadership confirmed their substantial importance for global innovation and close the chapter of pure cost-cutting discussions. These are two stories other European companies can learn from.

Roche’s Digital Center of Excellence (CoE) in Pune is the company’s only 100% digital hub globally. The center grew from a startup acquisition into a full-scale innovation hub and focuses exclusively on data, AI, and software. The CoE is instrumental in Roche’s "5P" healthcare strategy: Prevent, Predict, Personalise, Peace of Mind, and Point of Care, and builds AI diagnostics and data-anonymisation platforms used in labs worldwide. On top, it collaborates with IIT’s and the ecosystem.

Novartis follows a more R&D driven approach and has turned its India hubs (Hyderabad and Mumbai) into "HQ Twins" that touch almost every aspect of the company’s drug development. The India teams lead chemistry, biostatistics, and clinical operations, and are therefore tightly embedded in the innovation pipeline. This includes the world’s most advanced medical platforms, including radioligand therapy (RLT) and xRNA therapies. On top, their Indian data engineers developed tools like Protocol.AI to accelerate "speed to evidence", allowing global leadership to make costly "go/no-go" decisions faster than ever before.

These examples show the advantages and potential Indian GCCs provide for European businesses throughout all sectors, and cost-cutting is clearly not one of them. As I’ve worked in market entry for GCCs in my capacity as advisor, I regularly educate business leaders on the momentum of India’s innovation ecosystems and why it is crucial for their company to be more present. Availability of talent, ecosystem partnerships, and deep skillsets in cutting-edge technology are key reasons why GCCs gained in prominence in the first place and still do.

Sources: Express Computer, Business Today

Quick Risers

Vietnam’s Vingroup signed MoU with Telangana government and will invest USD 3 billion. (Source: Marco Förster)

GCCs were top office real estate driver in 2025. (Source: Moneycontrol)

India becomes world’s largest rice producer surpassing China. (Source: The Economic Times)

BCG thinks India is one of the most promising consumer good markets globally. (Source: The Economic Times)

Germany’s NXTGN Startup Factory and Kerala partner for deep tech ecosystem. (Source: Fortune India)

European Eutelsat considers partnering with ISRO for global satellite coverage. (Source: IndianWeb2)

US fashion brand Lululemon enters India with Tata Cliq in 2026. (Source: Fibre2Fashion)

Germany’s KfW signs MoU with HUDCO for EUR 200 million loan agreement in green infrastructure. (Source: Indian Masterminds)

Germany’s Klett Group partners with HMI Learning. (Source: Entrepreneur)

Netherlands and India sign MoU for joint trade and investment committee. (Source: The Economic Times)

Hydrogen Europe CEO claims India being among the strongest hydrogen players globally. (Source: The Economic Times)

Singapore’s Capitaland plans green energy platform in India. (Source: VCCircle)

EU Official claims that India might face 25% GDP loss by 2070 due to climate change. (Source: The Hindu)

China’s Envision might build battery manufacturing plant in India. (Source: Times of India)

Carmakers are awaiting EU India FTA before improving EV production schemes. (Source: Telegraph India)

Spotlight: How India is Rewriting the AI Playbook

India will host the AI Summit in February 2026. In a recent conversation of Inside Tech by The Economist, the participants cover what India does differently and what it could mean for global AI adoption.

Check out the 5 minutes short video here:

Curiosity Corner

Your random facts and stories about India and the Indo-European friendship.

This week: The Bindi

The bindi, derived from the Sanskrit word bindu for "dot", is a profound symbol in Indian culture that marks the Ajna Chakra, or the "third eye". Positioned between the eyebrows, this spot is considered the seat of concealed wisdom and the center for concentration during meditation. Spiritually, the bindi is believed to help retain energy and strengthen one’s focus, while traditionally, a bright red bindi served as a social signifier of a woman’s married status and her role as a protector of the household’s prosperity.

In the modern era, the bindi has evolved from a ritualistic requirement into a versatile fashion statement embraced globally. While its sacred roots remain respected, many people now wear bindis of various colors, shapes, and jewels to complement their style or celebrate their heritage during festivals and weddings. Whether it is a simple smudge of sandalwood paste or a glittering adhesive gem, the bindi remains a powerful emblem of identity that beautifully bridges the gap between ancient spiritual tradition and contemporary self-expression.

Enjoyed this issue? Share India Rising with your network.

Whenever you’re ready, here are 3 ways I can help you:

1. Real Estate Services

Whether you're optimising a corporate real estate portfolio, leading a development project, or plan a transaction, I can help you. I support and advise clients on a fractional, interim, or project basis to de-risk and deliver tangible results.

2. Market Entry India & Emerging Markets

As Strategic Advisor to Zinnov, a leading consultancy for globalisation in Tech, I help you set up your organisation’s GCC in India and Emerging Markets.

3. Collaborations & Promotions

I’m a proponent of ecosystems and partnership networks. Whether it’s collaborating on a project, participating in your event or promoting ideas: just reply to this email.

You can’t get enough or want to catch up on past editions? Follow the link!