Hey Risers

Thank you for being part of India Rising. It’s great to have you here.

Here are the topics of this week:

India's renewable energy trajectory is accelerating, and reshaping global automotive and cleantech supply chains.

The India Stack is going global: Over 100 countries are looking to replicate India's digital public infrastructure success.

Germany's Bertelsmann takes majority stake in logistics platform Lets Transport, signaling growing corporate commitment to India's fragmented markets.

And much more.

It’s a wrap! Our India Rising Perspective “Inside the $1 Trillion Economy” by Godson George Micheal Rai and Priyadarshini Samikumar came to an end and I hope you enjoyed the fourth and final issue. “Tamil Nadu: Where Global Manufacturing Finds Its Footing” covered the state’s manufacturing ecosystem. Overall, the series covered electronics manufacturing, GCCs, life sciences, and manufacturing ecosystems.

Learned something? Help someone else and share India Rising with your friends, family and co-workers. Let’s grow our community together and thank you for supporting the Indo-European partnership.

Got feedback? Just hit reply, I’d love to hear from you!

Number of the Week

100+

Over 100 countries are exploring adoption of India Stack's digital public infrastructure model, from digital identity to payments systems.

Rise of the Week: India's Renewable Energy Acceleration Signals Impactful Changes.

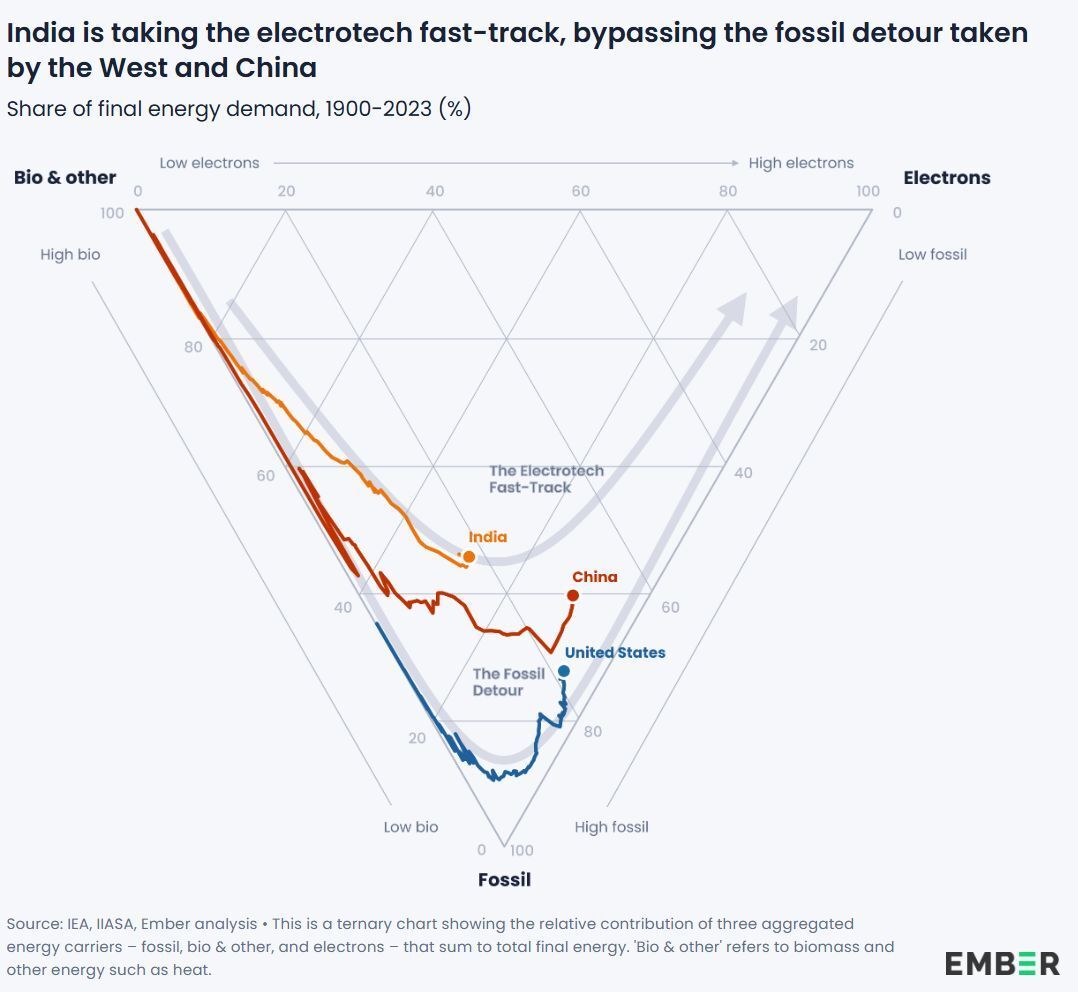

Economic growth correlates with energy demand. Historically, fossil fuels drive this growth, with renewables typically gaining share only after economies mature. However, recent data suggests India may bypass the extended fossil fuel era entirely.

Source: Ember “India’s electrotech fast-track: where China built on coal, India is building on sun” (2026)

Last year, India overtook Germany as the third largest generator of electricity from wind and solar. The recent analysis “India’s electrotech fast-track: where China built on coal, India is building on sun” by the energy think tank Ember shows India’s industrialisation increasingly happens outside of historically long phases of fossil powered energy.

Source: Ember “India’s electrotech fast-track: where China built on coal, India is building on sun” (2026)

Comparisons with China, the global renewable energy leader, at equivalent income levels of USD 11,000 PPP (China reached this in 2012) reveal stark differences:

Solar deployment: 9% of India’s electricity is generated with solar, up from 0.5% in 10 years. China’s was negligible at similar income levels in 2012.

Coal usage: India’s electricity generation from coal is around 1 MWh per capita, 40% of China’s in 2012. This means that India will most likely reach “peak coal” much earlier.

Mobility driven oil demand: At 96 litres per capita, oil demand is at half of China’s demand at similar income levels.

EV adoption: Electric vehicles account for around 5% of annual sales in the third largest automotive market, and India is leading sales for electric three wheelers globally. China had almost no electric cars on the road in 2012.

Electrification rate: At around 20%, India’s electrification rate is on a similar level to China in 2012, and growth is accelerating.

Source: Ember “India’s electrotech fast-track: where China built on coal, India is building on sun” (2026)

These numbers tell a compelling story. At a similar level development, India’s reliance on fossil fuels (India is the 2nd largest net-oil importer after China) is therefore much lower and electrification levels are growing fast. This will increase India’s energy sovereignty and impact adoption of clean energy technology. Solar panels, grid-scale battery storage, and electric vehicles have become substantially cheaper and India is building out its own ecosystem.

This will have two clear impacts:

Electricity supply: Renewable energy in combination with battery storage will grow substantially.

Electricity adoption: Electrification will become economically advantageous and industries such as mobility, manufacturing and buildings will be electrified.

The mobility sector, one of Europe’s traditional sectors, is already impacted by the shift towards clean energy:

5% of all annual car sales are EVs (as of mid 2025)

60% of all three-wheelers are EVs (India is market leader in the segment)

Sales of two-wheeler EVs increased four-fold between 2020 and 2024

This will require the European automotive industry to adapt accordingly. As I had reported in prior issues, East Asian and domestic competitors are already producing EVs in India and are ramping up production for export to Europe and the US as well. On the back of India’s large and growing automotive market, these players will therefore increase competition in other markets as well thanks to better margin profiles.

But also the supply side is developing fast. India already has the capacity to produce 120 GW of solar modules, which makes India self-sufficient following a twelvefold increase in just 10 years. Solar cells increased to 18 GW from basically zero a decade ago.

To build out the ecosystem, India is increasingly expanding its budget for climate resilience and now allocates around 5.6% of its GDP for broad climate action, according to India’s union finance minister Nirmala Sitharaman. A comparison to European levels is difficult given the various different states of development and classifications of budget usages (India heavily weighs adaptation and development schemes in this figure), but the allocation can be considered substantial.

One key sector that is under development and enjoys Indo-European attention is green hydrogen:

2 GW green hydrogen hub: Construction for India’s largest green hydrogen project started. AM Green’s hub is focused on exports to Europe and is one of the world’s largest green hydrogen projects. It secured an agreement with Uniper, a German energy company, and is in discussions with BASF and RWE as well. The hub will be powered by 7.5 GW renewable energy.

Thyssenkrupp Nucera and GIZ partnership: The German electrolyser company is partnering with the German development agency to secure green hydrogen opportunities.

Overall, India’s cleantech trajectory is visibly accelerating and impacting supply chains and consumer markets. European businesses must be aware not only of the opportunities, as several renewable energy players already do, but challenges alike. Mobility is one sector of fast adoption, and whole ecosystems and supply chains are being built around those that will eventually increase competition in markets outside of India as well.

Sources: Ember, Times of India, Fuelcellsworks, H2 View

What Else is Rising?

The India Stack is About to Go Global

Technological developments are often perceived as pure private enterprise successes. Historically however, whether it’s semiconductor developments or telecommunications, the underlying factors were public resources, investments, and partnerships. The India Stack, a set of open APIs and digital public goods for identity, data, and payments, is such an example. It provides an infrastructure and operating layer that allows inclusive technological developments in the digital age, built at scale. And over 100 countries globally have expressed interest in adopting its strategy.

India has had great success with the India Stack and the numbers speak for themselves:

UPI (digital payments): A total of 185.8 billion transactions were processed through UPI in India’s FY2025. This accounts for nearly 85% of India’s digital payments and a growth of 41.7% year-over-year.

Aadhaar (digital identity): Over 1.3 billion Indians (around 95%) possess a digital identity enabling remote authentication for documents from driver's licenses to insurance policies, via government-backed digital signatures.

Data Empowerment and Protection Architecture (DEPA; data layer): DEPA’s role is to restore the ownership and control over your user data and protects individual ownership rights.

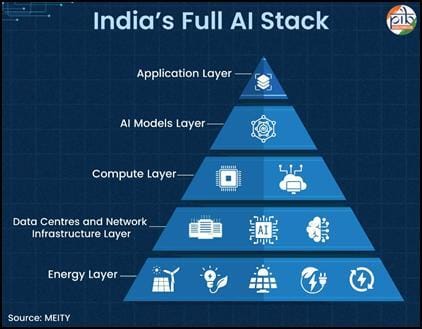

Building on this foundation, India is now positioning itself for the AI era. The India Stack’s success is about to be replicated in the AI age as well in order to secure strategic autonomy and inclusivity at scale. India’s AI Stack follows a five-layer approach:

Source: Government of India (2026)

Application layer: User facing layer that includes apps and services such as translation services, or chatbots.

AI models layer: Domestically developed AI models to secure sovereignty and inclusivity given India’s high diversity in culture and languages

Compute layer: India is building a compute infrastructure that can be accessed via a Compute-As-A-Service model. It allows AI models to operate at scale and at lower costs.

Data centre and network infrastructure layer: A nationwide optical fiber, 5G and data centre network to provide the main infrastructure for AI processing.

Energy layer: India continues to build out its energy infrastructure and focuses on secure, clean, and affordable energy sources.

The India Stack and AI Stack are ambitious, and already successful, public infrastructure models that provide the underlying layer for private business development that is highly inclusive, cost-efficient, and scalable. I’ve covered data centre and infrastructure developments several times before and think we will see many more ambitious projects coming. European businesses that intend to tap into India’s technology markets should be aware of its potentials and structure in order to be able to integrate and compete successfully. European policymakers and businesses alike have much to learn from this model.

Sources: India Stack, The Economic Times, Government of India

Germany’s Bertelsmann Takes Majority Stake in Logistics Platform Lets Transport

India is gaining focus for international investments and Bertelsmann, via its investment arm BI, announced that it has increased its stake with Lets Transport to over 80%. Lets Transport is a platform that connects India’s independent truck drivers with businesses of all sizes, sort of an “Uber for trucks”.

India’s logistics market is highly fragmanted, but around USD 300 billion in size and growing at an 8-9% CAGR. With European logistics players such as DHL, Rhenus or Fiege increasing their presence in India (see past issues of India Rising), BI’s announcement confirms the market potential and the trajectory since its initial investment in the platform from 2018.

The numbers for Lets Transport confirm the potential:

Market size: Around USD 14 billion

Market growth rate: 11%

Market fragmentation: 90% unorganised

Number of drivers on platform: 250,000

Revenue 2025: around USD 100 million

Revenue growth 2025: around 40%

Bertelsmann has been present in India for over 40 years through various business segments and is increasing its focus on the country. I expect more corporate investments to follow as European businesses deepen their India commitments and build local market knowledge.

Sources: Handelsblatt

Quick Risers

India does now have over 958 million internet users, with 57% located in rural areas. (Source: The Hindu)

Germany’s Enulec Electrostatic, specialised in packaging solutions, says India is company’s most important market globally. (Source: Packaging South Asia)

German EW Group to invest INR 200 crore (around EUR 23 mn) in poultry sector over 3 years. (Source: Business Standard)

Pune ranked second largest GCC market in 2025 in terms of office leasing volumes. (Source: The Hindu)

Greece eyes defence partnership with India. (Source: EURACTIV)

US bank Morgan Stanley considers USD 500 mn India Fund. (Source: The Economic Times)

Karnataka government and the City of Dusseldorf sign Letter of Intent to strengthen technology cooperation. (Source: Moneycontrol)

India and EU begin talks for India to join EUR 95.5 bn Horizon Europe program. (Source: NewsBytes)

Italy’s Leonardo and India’s Adani team up to produce military helicopters in India. (Source: The Economic Times)

Google secures 3 office towers for a 2.4 mn sqft hub in Bengaluru. (Source: IndianWeb2)

Amazon teams up with IIT Roorkee to develop sustainable packaging material based on agri waste. (Source: The Economic Times)

Apple grew double digits in revenue and users in India in the last quarter. (Source: Times of India)

AM Group is building a 1 GW AI Hub in Greater Noida, Uttar Pradesh, and plans to invest USD 25 bn. (Source: Times of India)

Spotlight: Referral Program

I truly appreciate you being part of India Rising. Our mission is to track India’s path to becoming the world's 3rd largest economy, and your engagement throughout our channels has been fantastic. To provide even more value and grow our community of Indo-European leaders, I’m launching a referral program.

The 2026 Strategic Outlook serves as a curated executive brief on the most significant economic catalysts (events, major IPOs, economic data etc.) shaping the Indo-European corridor this year and is not available on the website.

How to unlock it: Simply refer one reader to India Rising using your unique link below. Once they join, the 2026 Strategic Outlook will be sent to your inbox immediately.

Curiosity Corner

Your random facts and stories about India and the Indo-European friendship.

This week: India's First Computers: A British Import and Indigenous Innovation

India's computer age began with an interesting dual track in the 1950s. In 1955, the Indian Statistical Institute in Kolkata installed a British-built HEC-2M computer, making it the first digital computer in Asia outside Japan. The behemoth measured 10 feet by 7 feet by 6 feet and took 15 minutes to calculate the square root of a 16-digit number using punched cards.

But parallel to this, a team of young physicists at Mumbai's Tata Institute of Fundamental Research (TIFR) set out to build India's first indigenous computer. The catch? None of them had ever operated a computer, let alone built one. By 1960, TIFRAC (TIFR Automatic Calculator) was commissioned by Prime Minister Jawaharlal Nehru himself, featuring 2,700 vacuum tubes and cutting-edge magnetic core memory. It ran two shifts daily to meet demand from over 50 organisations, from atomic energy research to artillery trajectory calculations.

Enjoyed this issue? Share India Rising with your network.

Whenever you’re ready, here are 3 ways I can help you:

1. Real Estate Services

Whether you're optimising a corporate real estate portfolio, leading a development project, or plan a transaction, I can help you. I support and advise clients on a fractional, interim, or project basis to de-risk and deliver tangible results.

2. Market Entry India & Emerging Markets

As Strategic Advisor to Zinnov, a leading consultancy for globalisation in Tech, I help you set up your organisation’s GCC in India and Emerging Markets.

3. Collaborations & Promotions

I’m a proponent of ecosystems and partnership networks. Whether it’s collaborating on a project, participating in your event or promoting ideas: just reply to this email.

You can’t get enough or want to catch up on past editions? Follow the link!