Hey Risers

Thank you for subscribing to India Rising. Our community continues to grow and great to have you with us!

This week's edition brings you crucial insights on India's automotive sector, the momentum in office markets incl. green developments, and more must-know news.

Coming soon: our first special feature! Fellow Risers Kanwar Vivswan (Osborne Clarke) and Janine Haesler (Vischer) will share their expert analysis on the EU-India Free Trade Agreement.

Stay tuned and help us expand our reach by sharing India Rising with your network.

Got feedback? Just hit reply, I’d love to hear from you!

Rise of the Week: Global Carmakers Invest in India, but European OEMs are Far Behind

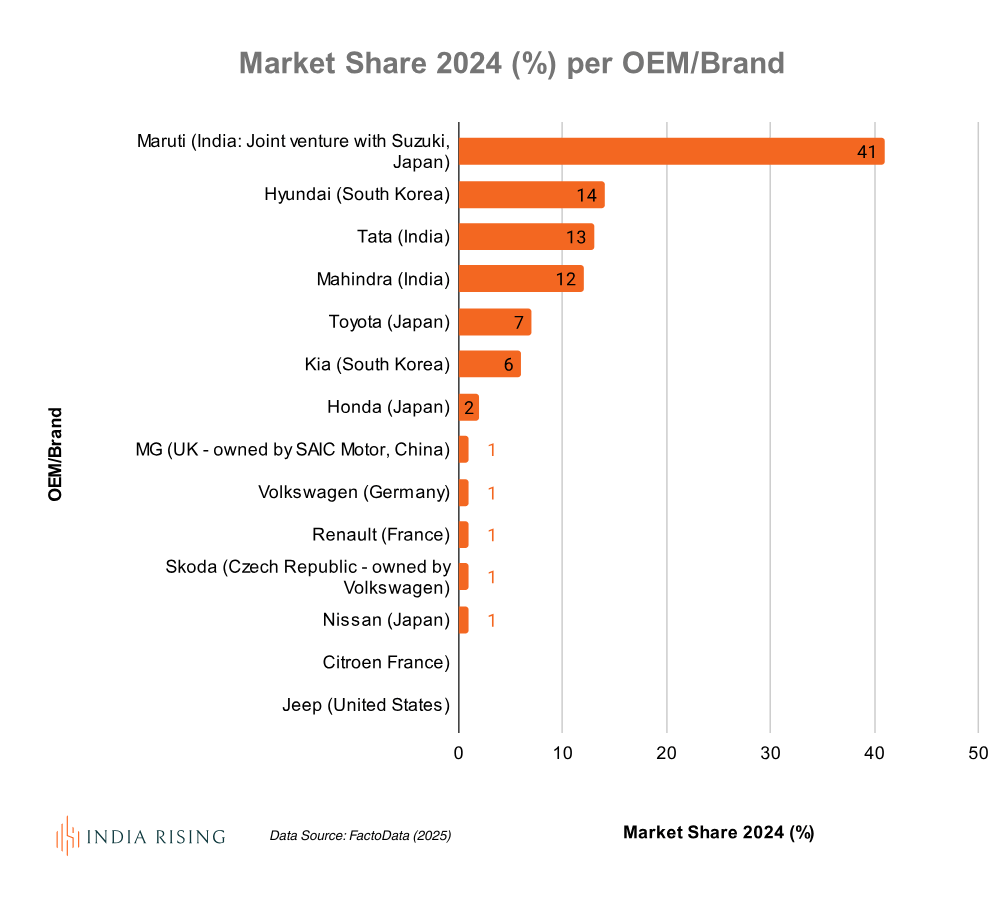

India’s automotive market is the 3rd largest globally and strongly consolidated. The top 6 OEM’s command a market share of 92%, and none of them are European. As India’s passenger car market expects a growth of around 50% by 2030 compared to 2023 (7.5 million units vs. 5.1 million units), OEMs start (re-)positioning themselves.

Japanese brands, local manufacturers (and their joint ventures with Japanese and South Korean OEMs), and South Korean players dominate India's automotive landscape. Hyundai even reported the largest IPO in India in 2024.

Several announcements of strategic investments confirm the growing significance of India’s automotive market, particularly while European brands struggle with fierce competition in China, the largest automotive market globally:

Stellantis is accelerating its EV offerings in the Indian market through its Chinese joint venture partner Leapmotor

Renault inaugurated a new design and R&D center in Chennai, its largest outside of Europe

Hyundai announced a Center of Excellence at IIT Delhi with focus on Future Mobility

Skoda has set ambitious targets to sell over 100,000 vehicles in 2026, more than double the units of recent years

Tesla started hiring in India and is evaluating manufacturing opportunities

What explains the Korean and Japanese success? Arun Malhotra, former managing director of Nissan India, highlighted in Forbes India that these manufacturers excel at three critical elements that European and US competitors keep lacking: local management autonomy, market-specific product development, and relentless focus on cost efficiency.

These factors aren’t only an advantage in the Indian market, but enable companies like Hyundai to scale up manufacturing capacity for the entire region from their Indian operations, significantly improving unit economics. This is particularly valuable due to the high import tariffs for cars into India (>100%):

By leveraging our strong reputation and competitive quality in India, we aim to expand exports to neighbouring countries, making India the global export hub to boost our regional market competitiveness.

European brands entered India at the same time (mid 1990s), or in case of Fiat even earlier (mid 1960s), as their Korean and Japanese competitors, yet they are at risk of being left behind. India's ambitious EV transition, targeting 30% of new sales by 2030, might present a crucial opportunity for European manufacturers to recalibrate their approach and regain competitiveness in this vital market.

Sources: Forbes, FactoData, Reuters, Autocar India, IndianWeb2, The Economic Times, Deutsche Welle, Forbes India

What Else is Rising?

India’s Office Market & Green Developments

India’s growing economic importance is reflected in its thriving real estate market. While institutional investments remain robust (as detailed in issue 3), office leasing figures for Q1 2025 demonstrate resilient demand with gross leasing volume increasing 5% year-over-year and vacancy rates declining for the 7th consecutive quarter, according to Cushman & Wakefield.

Although new supply has fallen short of projections due to project delays and pending regulatory approvals, pre-commitments by occupiers have more than doubled compared to the previous quarter - a clear indicator of sustained demand. Major developers are strategically responding to this trend by prioritizing quality and sustainable developments to secure premium tenants:

Driven by occupier demand and institutional investors such as Blackstone, Brookfield Properties or CapitaLand, the majority of India’s office stock is now green certified following a growth of 35% year-over-year in 2024.

Sources: Cushman & Wakefield, The Economic Times

Quick Risers

The Japanese tech company Rakuten announced a USD 100 Million investment in its India GCC presence to enhance AI developments in 2025. (Source: Tech in Asia)

The German mobility provider FlixBus will launch 500 electric buses across India. (Source: The Economic Times)

Walmart announced a new GCC in Chennai to accommodate 4,500 employees in addition to its major GCC in Bengaluru. (Source: IndianWeb2)

Alexander Sixt, Managing Director of the German mobility provider SIXT, shared insights from its Tech Conference in Bengaluru and confirmed the location’s importance in their global tech organisation. (Source: Alexander Sixt via LinkedIn)

The world’s largest industrial REIT and developer Prologis shared details on its recently announced investment pipeline in India. (Source: Prologis)

Spotlight: Indo-German Healthcare Congress 2025

The Indo-German Young Leaders Forum is seeking applications for the Indo-German Healthcare Congress 2025.

Source: Indo-German Young Leaders Forum (2025)

Application deadline is May 12th and find more details here.

Curiosity Corner

Your random facts and stories about India and the Indo-European friendship.

This week: History of the EU-India Strategic Partnership

The EU – India bilateral relations date back to the early 1960s with India being among the first countries to establish diplomatic relations with the European Economic Community in 1962. The EU-India Cooperation Agreement signed in 1994, opened the way to strengthening bilateral ties. The relationship was upgraded to a "Strategic Partnership" during the 5th summit of India-EU in The Hague in 2004. The year 2024 marked the 20th anniversary of the EU-India Strategic Partnership gaining momentum, as India seeks a multi-polar world and deeper cooperation with the EU.

Enjoyed this issue? Share the newsletter with your network.

Whenever you’re ready, here are 3 ways I can help you:

1. Real Estate Services

From Corporate Real Estate and Workplace services to holistic real estate consulting and development support, I’ll help you focus on your core business.

2. Market Entry India & Emerging Markets

As Advisor to Zinnov, a leading consultancy for globalisation in Tech, I help you set up your organisation in India and Emerging Markets.

3. Collaborations & Promotions

I’m a proponent of ecosystems and partnership networks. Whether it’s collaborating on a project, participating in your event or promoting ideas, please reach out.

You can’t get enough or want to catch up on past editions? Follow the link!