Hey Risers

Thank you for subscribing to India Rising. Our community continues to grow and great to have you with us!

This is our next special issue: a guest article on Green Hydrogen: Unlocking India–Germany Synergy in the Global Energy Transition.

Enjoyed the deep dive? Help us expand and share India Rising with your network.

Got feedback? Just hit reply, I’d love to hear from you!

Today’s guest author is our fellow Riser Adithya Nataraj Ramalingam.

Guest Author - Special Issue “Green Hydrogen: Unlocking India–Germany Synergy in the Global Energy Transition”

Adithya is a seasoned expert and long-standing contributor to the green hydrogen sector in both Germany and India. With 14+ years of experience in green hydrogen, sustainability consulting, digital transformation, and renewable energy systems, he was responsible for projects in both Germany and India, and has worked with companies such as Brenntag, Uniper and Cognizant.

Let’s jump in.

Green Hydrogen: Unlocking India–Germany Synergy in the Global Energy Transition

From Adithya Nataraj Ramalingama

Green hydrogen is emerging as one of the most promising solutions for deep decarbonisation across industries, transport, and power systems. Produced by splitting water using renewable electricity, it is free of carbon emissions and can be stored, transported, and used across multiple sectors.

India and Germany—two economies with complementary strengths—are well-positioned to become global leaders in this space. India offers cost-effective renewable energy, abundant production potential, and a strategic location for exports. Germany brings advanced hydrogen technology, strong industrial demand, and a pressing need to secure imports to meet climate goals.

This synergy creates a unique opportunity: a robust hydrogen trade and technology partnership that benefits both nations while contributing to global climate targets.

Green Hydrogen Demand Outlook

To understand the scale and urgency of the hydrogen opportunity between India and Germany, it is important to first examine the demand trajectories in both countries and identify where complementarities exist.

Germany

Germany currently consumes about 55–60 TWh/year of hydrogen, mainly in refining and ammonia production, with most of it derived from fossil fuels (grey hydrogen) [3]. Demand is projected to reach 95–130 TWh/year by 2030 and between 360–500 TWh/year by 2045 [1][3].

Because domestic production will be insufficient, 50–70% of Germany’s hydrogen needs will come from imports [4][5]. Large industrial clusters such as the Ruhr area, Hamburg, and Saxony will be the primary consumers, focusing on green steel, chemicals, heavy transport, and energy storage.

India

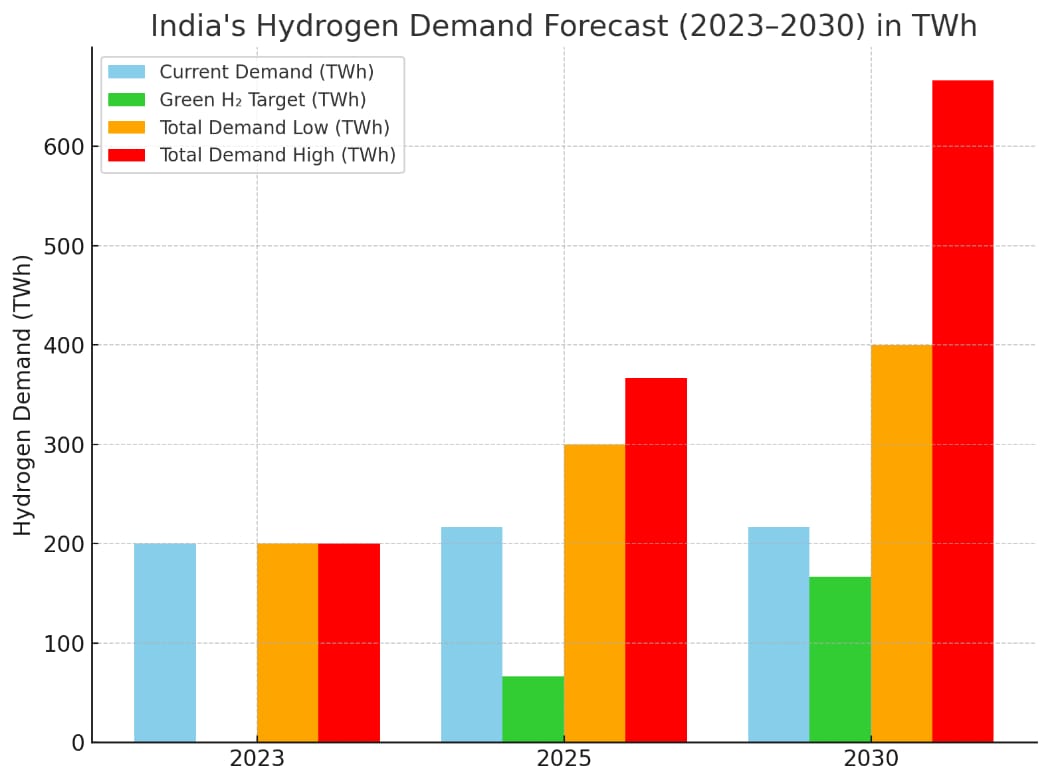

India’s current hydrogen consumption stands at approximately 200 TWh/year (~6 MMT), dominated by oil refining (100 TWh/year) and fertiliser production (83 TWh/year) [6][7]. By 2030, demand is expected to double to approximately 400–667 TWh/year (12–20 MMT), with at least 167 TWh/year (5 MMT) targeted as green hydrogen under the National Green Hydrogen Mission [8].

Beyond domestic use, India is positioning itself as a future exporter of green hydrogen derivatives such as ammonia and methanol, leveraging competitive renewable energy prices and port infrastructure in Gujarat, Tamil Nadu, and Andhra Pradesh.

Figure 2: India’s estimated hydrogen demand landscape

Sectoral Demand Drivers

Hydrogen demand is not uniform across sectors. Each country has distinct priorities based on its industrial structure, energy mix, and decarbonisation roadmap. The table below discusses the key focus areas in Germany and India.

Sector | Germany Focus | India Focus |

|---|---|---|

Industry | Green steel, chemical feedstock, ammonia production | Fertilizers, steel, cement, oil refining |

Mobility | Heavy-duty transport, shipping, aviation fuels | Public transport fuel cells, green aviation fuel pilots |

Energy Storage | Hydrogen-ready power plants, seasonal storage | Grid balancing, hybrid RE-hydrogen systems in RE zones |

Exports | Ammonia and LOHC imports | Ammonia and methanol exports to Europe and Asia |

Germany’s focus is on heavy industry, advanced mobility, and storage, whereas India’s strengths lie in scaling hydrogen for fertilisers, refining, and exports. These differences make the two economies highly complementary—Germany can serve as a technology partner while India can become a large-scale producer and supplier.

Understanding the Hydrogen Value Chain

The hydrogen value chain spans seven key stages, each critical to its large-scale deployment:

Production: Hydrogen generation from renewable sources via electrolysis; colour-coded (green, blue, grey) based on carbon footprint.

Compression: Increasing pressure (350–700 bar) to enhance storage and transport efficiency.

Storage: Safe containment in pressurised tanks, cryogenic liquid form, or geological structures like salt caverns.

Distribution: Delivery through pipelines, road tankers, or shipping (as ammonia/LOHC for long distances).

Utilisation: Application in industry, power generation, transport, and heating.

Decompression: Pressure reduction for safe use in industrial and commercial systems.

Conversion: Reconversion into electricity, heat, synthetic fuels, or chemicals.

Figure 3: The Hydrogen Value Chain – From Production to Utilisation

Understanding the hydrogen value chain is crucial because it highlights the interdependence of each stage. Weakness in one link—whether production capacity, storage, or distribution—can cause hinderance to the entire ecosystem. This perspective also guides strategic cooperation, as India and Germany can complement each other’s strengths across the chain.

Major Hydrogen Projects - Germany and India

To illustrate the hydrogen ecosystem in action, we look at some hydrogen projects across different value chain stages in both countries.

Production – Hamburg Green Hydrogen Hub [14]

Partners: Shell, Mitsubishi, Vattenfall, Wärme Hamburg.

100 MW electrolyser to produce renewable hydrogen using wind power.

Conversion of a coal plant site into a hydrogen hub.

Indian relevance: Repurposing decommissioned coal sites in Jharkhand and Odisha.

Compression – H2Haul Project (North Rhine-Westphalia) [15]

Deployment of high-pressure refuelling stations for heavy-duty hydrogen trucks.

Technology: Compression to 700 bar for mobility applications.

Indian relevance: Could support hydrogen-powered logistics corridors like Delhi–Mumbai Expressway.

Storage – EWE Hydrogen Cavern, Lower Saxony [16]

Conversion of salt caverns to store hydrogen at scale.

Capacity: Potential to store thousands of tonnes of H₂ for seasonal balancing.

Indian relevance: Similar caverns exist in Gujarat’s Kutch region.

Distribution – GET H2 Nukleus [17]

First open-access hydrogen pipeline network in Germany.

Connects production facilities to industrial clusters and storage sites.

Indian relevance: Model for hydrogen corridor development between RE hubs and industrial belts.

Utilisation – Salzgitter Low CO₂ Steelmaking (SALCOS) [18]

Partners: Salzgitter AG, Tenova, Paul Wurth.

Uses hydrogen in direct reduction of iron (DRI) to produce green steel.

Indian relevance: Adaptation in Steel plants to cut steel emissions.

Decompression – H2 Mobility Refuelling Network [19]

National network of hydrogen stations equipped with decompression systems.

100+ stations planned by 2030.

Indian relevance: Early deployment in metro cities for buses and fleet vehicles.

Conversion – Hydrogenious LOHC Technologies [20]

Technology: Binds hydrogen to liquid carriers like toluene for safe transport.

German R&D leadership could enable India to scale ammonia/LOHC exports to Europe.

Selected Projects Supporting Indo-German Collaboration

Here’s an overview of a range of ongoing Indo-German collaborations:

Andhra Pradesh Green Hydrogen & Ammonia Project – ₹10,000 crore investment by German Select Energy & Juno Joule [9].

Indo-German Offshore Wind–Green Hydrogen Task Force – A joint study has identified the potential to produce 100 GW of green hydrogen through offshore wind in Tamil Nadu and Gujarat. This capacity alone could fulfil India’s 5 MMT green hydrogen production target under the National Green Hydrogen Mission.[21]

AEG Power Solutions – Statcon Energiaa Rectifier Partnership – Germany’s AEG Power Solutions has licensed its MW-class rectifier technology to Indian manufacturer Statcon Energiaa. This enables local production of high-efficiency hydrogen-electrolyser power systems using core German components [22]

RWE – AM Green Ammonia Long-Term Supply MoU – RWE Supply & Trading has signed an MoU with AM Green Ammonia to import up to 250,000 tonnes per year of RFNBO-compliant green ammonia from India’s Kakinada and Tuticorin plants, starting from 2027 [23]

These initiatives demonstrate how joint studies, technology transfer, and commercial agreements can build a robust Indo-German and Indo-European hydrogen corridor. By aligning India’s production strengths with Germany’s demand, both sides can accelerate their decarbonisation strategies while also shaping global hydrogen markets.

India–Germany Roles Across the Hydrogen Value Chain

By mapping the strengths of India and Germany across the hydrogen value chain, we can identify where synergies exist and where partnerships could yield the greatest mutual benefits:

Value Chain Stage | India’s Strengths & Focus Areas | Germany’s Strengths & Focus Areas |

|---|---|---|

Production | Abundant low-cost solar & wind; large-scale RE projects in Rajasthan, Gujarat, Tamil Nadu; strong policy incentives. | Advanced electrolyser R&D; offshore wind-hydrogen integration. |

Compression | Growing industrial compression capabilities; global technology partnerships. | Mature high-pressure compression tech; safety and certification leadership. |

Storage | Geological potential for salt cavern storage (Gujarat, Rajasthan). | Operational hydrogen cavern projects (Etzel, EWE); advanced cryogenic storage. |

Distribution | Port facilities for ammonia/LOHC exports (Mundra, Kandla, Vizag). | Hydrogen-ready pipelines; upgraded import terminals (Wilhelmshaven, Hamburg). |

Utilisation | Large industrial clusters; transport fuel cell pilots. | Green steel, chemicals, heavy mobility, aviation fuels. |

Decompression | Scaling capabilities for hydrogen supply networks. | Decompression solutions for multiple end-use sectors. |

Conversion | Green ammonia/methanol production for export & domestic industry. | LOHC leadership; Power-to-X fuel conversion expertise. |

The table underscores a complementary fit—India has scale and low-cost production potential, while Germany offers advanced technology and high-value industrial use cases. This alignment creates fertile ground for joint ventures, technology transfer, and long-term supply agreements.

Germany’s Import Opportunity and India’s Role

Germany’s growing hydrogen demand is not just a domestic challenge—it is a major strategic opportunity for India and for Indo-European collaboration. With Germany targeting large-scale imports to meet its climate goals, India is uniquely positioned to become a long-term supplier, supported by competitive renewable energy, proven ammonia production, and strong port infrastructure.

Germany’s Hydrogen Import Strategy sets a goal to import 100 TWh/year via pipelines by 2035 and additional volumes as ammonia, methanol, or LOHC by ship [4][5].

India’s advantages include:

Low-cost renewable power generation (solar tariffs as low as $0.03/kWh) [6]

Proven industrial-scale ammonia production capacity

Strategic coastal ports (Mundra, Kandla, Vizag) suited for hydrogen exports

Active Indo-German clean energy partnerships, including large-scale hydrogen projects in Andhra Pradesh and Gujarat [9][11]

Bilateral frameworks like H2Global and the Indo-German Energy Forum are already creating pathways for long-term purchase agreements and technology transfer [11].

Collaboration & Technology Transfer Opportunities

Building on the value chain analysis, there are several concrete areas where India and Germany can deepen their hydrogen cooperation—from infrastructure and R&D to policy alignment and financing.

Joint Infrastructure Development – Build hydrogen-ready ports in India and import terminals in Germany with shared investment and operational models.

R&D Partnerships – Link German research institutes like Fraunhofer and Helmholtz with India’s IITs for joint work on electrolyser efficiency, storage materials, and AI-based hydrogen grid management.

Industrial Integration Pilots – Launch Indo-German demonstration plants for green steel, green ammonia, and refinery hydrogen replacement.

Policy & Certification Alignment – Develop mutually recognised standards for green hydrogen guarantees of origin to ease trade.

Financing Mechanisms – Leverage Germany’s KfW development bank and India’s sovereign green bonds for blended project financing.

Skills Development – Create bilateral training academies for hydrogen technicians, safety inspectors, and plant operators.

Digitalisation & AI Collaboration – Integrate German digital hydrogen twin platforms with India’s renewable-hydrogen clusters for predictive maintenance and real-time optimisation.

Conclusion

Hydrogen is more than just an energy carrier—it is a strategic bridge between India’s renewable power potential and Germany’s industrial transition.

By anchoring cooperation in tangible projects across the value chain—from production and storage to utilisation and trade—India and Germany can not only accelerate their own decarbonisation targets but also shape the emerging global hydrogen economy.

A coordinated approach that combines India’s cost advantage in production with Germany’s expertise in storage, distribution, and industrial applications can deliver secure, sustainable, and scalable hydrogen solutions for decades to come.

Sources: (1) International Energy Agency (IEA) – Global Hydrogen Review 2023. (2)GTAI – Germany Trade & Invest: Green Hydrogen in Germany. (3) Federal Ministry for Economic Affairs and Climate Action – National Hydrogen Strategy. (4) Reuters – German government signs off hydrogen import strategy, July 2024. (5) Reuters – Germany could import up to 100 TWh of green hydrogen via pipelines by 2035. (6) Economic Times Energy World – India's hydrogen demand projections. (7) Economic Times Energy World – Hydrogen demand to hit 20 million tonnes by 2030. (8) AP News – India launches $2.3B National Green Hydrogen Mission. (9) Times of India – German Select Energy to invest Rs 10,000 crore in green hydrogen project in AP. (10) Global Hydrogen Organisation – Germany country profile. (11) Power-to-X – Germany and India cooperation on hydrogen. (12) Understanding the Sustainable Hydrogen Generation Potential for the Region of Bavaria, Germany via Bio-Waste Processing Using Thermochemical Conversion Technology. (13) Hydrogen core network. (14) Hamburg Green Hydrogen Hub. (15) Paving the road for a carbon neutral Europe. (16) Green Hydrogen from EWE – The Energy Carrier of the Future (17) GET H2 Nukleus (18) SALCOS - THE CONCEPT FOR A SUSTAINABLE FUTURE. (19) Fuelling progress with hydrogen (20) Carrying the new energy world. Handling hydrogen as an oil. (21) Indo-German Green Hydrogen Roadmap (22) Statcon Energiaa and AEG Power Solutions Forge Strategic Partnership to Power India’s Green-Hydrogen Ambitions (23) RWE – AM Green Ammonia Long-Term Supply MoU

Contact the Author

If you want to explore more on this topic or have questions, please reach out to the authors via LinkedIn:

How did today's guest article resonate with you?

Enjoyed this issue? Share the newsletter with your network.

Whenever you’re ready, here are 3 ways I can help you:

1. Real Estate Services

From Corporate Real Estate and Workplace services to holistic real estate consulting and development support, I’ll help you focus on your core business.

2. Market Entry India & Emerging Markets

As Advisor to Zinnov, a leading consultancy for globalisation in Tech, I help you set up your organisation in India and Emerging Markets.

3. Collaborations & Promotions

I’m a proponent of ecosystems and partnership networks. Whether it’s collaborating on a project, participating in your event or promoting ideas, please reach out.

You can’t get enough or want to catch up on past editions? Follow the link!