Hey Risers

Thank you for being part of India Rising. Our community of Risers keeps growing and it’s great to have you with us!

This week:

France and Germany deepen defence ties with India through major co-development agreements.

Volkswagen scales back India investments amid competitive pressures.

Indian banks might acquire Deutsche Bank's retail business

And much more.

India Rising Perspectives: We just announced our new product “India Rising Perspectives” and first collaboration. Check out this week’s Spotlight for more details and we are excited to share the first issue of the series by Godson George Micheal Rai and Priya Samikumar from Guidance Tamil Nadu later this week!

Found this week's edition insightful? Help us expand and share India Rising with your friends, family and co-workers. Let’s grow our community together and thank you for supporting the Indo-European partnership.

Got feedback? Just hit reply, I’d love to hear from you!

Number of the Week

USD 5.7 billion

This year’s M&A value of Indian businesses acquiring competitors in Europe.

Rise of the Week: The Indo-European Defence Collaboration is Deepening

Europe's defence sector, long a secondary concern, has gained sudden prominence as geopolitical tensions reshape strategic priorities. Both France and Germany are now actively seeking new defence partnerships and have turned their attention East, strengthening ties with India in a bid to diversify their alliances and bolster technological capacity.

Defence collaborations are inherently strategic and politically sensitive. Companies across Europe are increasingly seeking partnerships to accelerate technological development and expand manufacturing capabilities. Both France and Germany agreed with India on substantial new collaborations just last week:

India and Germany: During the India-Germany High Defence Committee meeting, both sides agreed on stronger ties especially in co-development and co-manufacturing of defence equipment.

India and France: Both countries signed a Technical Agreement for research and development efforts. It’s a two-way transfer to exchange equipment, know-how and technological capabilities.

These government-level agreements typically pave the way for commercial partnerships. Indeed, several commercial collaborations have already been announced or are under active consideration:

Germany’s HENSOLDT and India’s Hindustan Aeronautics Limited (HAL) agreed to jointly manufacture LiDAR-based Obstacle Avoidance Systems (OAS). The agreement covers technology transfer and local production, and is considered the most significant defence technology transfer between India and Germany in over 30 years.

The German and Indian governments are also in discussion to potentially reconsider market access for Rheinmetall, which currently faces a ban due to past bribery allegations.

French Safran Group continues fighter jet negotiations with India, while ThyssenKrupp explores potential submarine partnerships with the Indian government.

India's defence landscape has historically been anchored by partnerships with Russia, alongside an established domestic development and manufacturing base. Notably, broader Indian partnerships are themselves evolving and Brazilian Embraer Group recently signed a strategic cooperation agreement with India's Mahindra Group. Geopolitical developments appear to be reshaping defence relationships globally, creating clear potential for stronger Indo-European ties based on shared values and the strategic imperative to diversify supplier networks and reduce dependency.

This falls somewhat outside my usual focus, but these developments seemed important to flag given the scale and visibility of recent Indo-European defence cooperation.

Sources: Construction World India, Manufacturing Today, New Indian Express, The Economic Times

What Else is Rising?

Volkswagen Group Scales Back India Investments & Seeks Local Partner

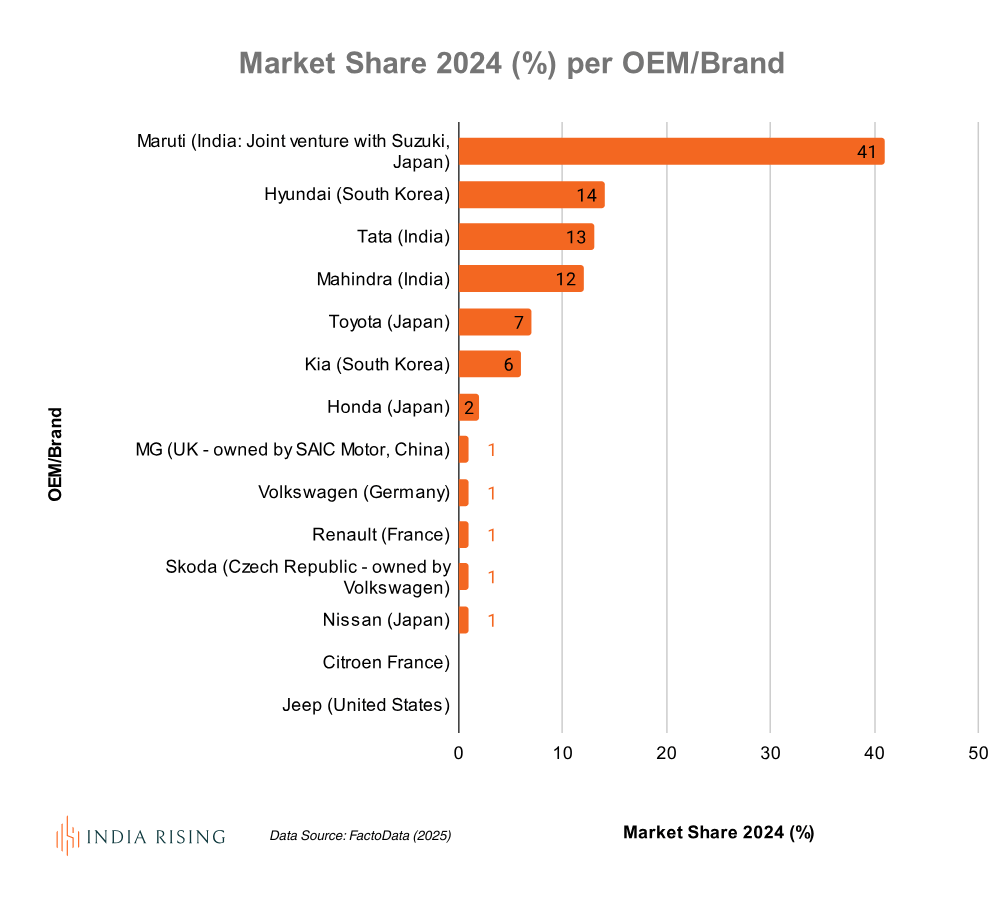

Volkswagen (VW) is Europe's largest carmaker and one of the biggest globally by volume. Yet after more than 20 years in India, the world's third-largest automotive market, VW Group has managed to secure only 2% market share and is now evaluating options to reduce domestic investments, a telling sign of strategic failure in a market where presence alone hasn't translated to competitiveness.

Data source: FactorData (2025) via India Rising Issue 7

The VW Group is the prime example of European carmakers’ struggle in the price sensitive, third largest automotive market in the world. While omnipresent in other markets globally, the group only managed to secure a market share of 2% in over two decades. This basically means that the company isn’t able to meet market demand.

On top of that, stricter carbon emission guidelines will be introduced domestically by 2027 and require local investments in Electric Vehicles (EV) platforms to stay price competitive. The VW Group initially allocated USD 1 billion for such investments, which are reportedly being reduced to USD 700 million in a way of redistributing funds between markets. All at a critical moment given VW Group’s readiness for an EV in India by 2028 at the earliest.

According to Bloomberg (via Yahoo Finance), various options are under consideration before additional funds will be approved internally:

Domestic partners: The VW Group has been looking for domestic partners such as JSW Group, the Indian partner of China’s SAIC Motor, and domestic contract manufacturers to share investments.

Import of EVs: As interim option, VW Group considers the import of EVs into India from other markets. At current tariff rates of 100% highly cost intensive, this could be an option if the upcoming EU-India Free Trade Agreement reduces these tariffs.

On paper, scaling back investments appears prudent given VW Group's current pressures: intense competition in China (the world's largest automotive market), lack of price competitiveness in EVs, persistent software issues, and eroding profit margins. Yet this strategy risks accelerating VW's decline rather than stabilising it. But I think this could add additional risk in established markets in the future.

Indian market leaders are investing billions not only to defend domestic positions but to execute "Make in India for the World" strategies, building globally competitive manufacturing at margins European players can no longer match. India is already the third-largest automotive market globally and growing rapidly. By reducing commitment now, VW risks ceding the market entirely to established Indian players and Japanese / Korean market leaders. That strategic retreat could intensify competitive pressure on VW in established Western markets as well, as Indian manufacturing capacity gains scale and export reach. The question is whether cost-cutting provides genuine relief or merely delays a more fundamental reckoning.

Sources: Bloomberg, Yahoo Finance, Factor Data

Indian Banks In Talks to Acquire Deutsche Bank Businesses

We recently reported on Deutsche Bank's plans to divest its retail branches. This second attempt in eight years appears to be gaining traction, with negotiations now progressing in India.

Image generated with ChatGPT

According to The Economic Times, Kotak Mahindra Bank and Federal Bank are in negotiations to acquire Deutsche Bank’s retail and wealth management business in India consisting of personal loans and mortgages. Deutsche Bank’s assets under management are valued at around INR 25,000 crore (EUR 2.78 billion).

India is the only market outside Europe where Deutsche Bank runs retail branches, an outlier situation that the bank intends to change to improve cost structures.This mirrors similar moves by competitors like Citi, which have exited or scaled back retail operations in India's highly competitive banking market where local players dominate and margins remain thin.

Apart from a trend in the banking sector, M&A development in terms of Indian businesses acquiring European assets has been strong in general. Indian M&A into Europe has reached USD 5.7 billion in 2025 including Tata Motor’s recent acquisition of Iveco Group.

Indian businesses benefit from well-capitalized balance sheets and a large, growing domestic market that funds expansion and innovation. European businesses, by contrast, face structural headwinds:

Compressed margins in maturing markets

Intensifying competition from Chinese and Indian entrants, and

The capital intensity required to transition to new technologies like EVs or digital banking.

For Indian acquirers, European assets, whether banking franchises, manufacturing capabilities, or industrial operations, offer established market positions, technology, and brand value at valuations that reflect these pressures. I expect this acquisition trend to continue as valuations remain attractive and Indian businesses continue gaining both financial capacity and strategic ambition.

Sources: The Economic Times

Quick Risers

Germany’s Inavia Aviation announced an investment of INR 2,000 crore (around EUR 222 million) for India’s first aircraft dismantling, maintenance, repair and overhaul (MRO) services site. (Source: Machine Maker)

German-French Airbus shares new outlook and expects APAC to drive half of global aerospace growth, especially India and China. (Source: Times of India)

Bengaluru Tech Summit concludes and reaffirms Karnataka’s vision. (Source: Indian Web2)

GE Aerospace expands its Pune manufacturing site and invests USD 14 million. (Source: IndianWeb2)

Germany’s Spiegel reports on self-driving car software by Minus One in Bengaluru (Source: Spiegel)

Germany and India forge deeper collaboration in economic and immigration topics. (Source: Business World)

Collaboration with French TotalEnergies for deep sea oil and gas exploration. (Source: The Economic Times)

Vanguard opens GCC in Hyderabad to drive innovation globally. (Source: Times of India)

Two major leases of over 50,000 sql each confirm Google’s commitment to India. (Source: Elite Agent)

EU’s rejection of India’s bid for carbon border tax exemption might slow down EU-India FTA discussions. (Source: Telegraph India)

How FTA could be catalyst for green transition. (Source: The Economic Times)

Spotlight: India Rising Perspectives

I’m super excited to announce the launch of India Rising Perspectives, a new product of exclusive collaborations that brings you a multi-part series from leading organisations dedicated to providing strategic insider views on India's economic rise.

And we are launching with an incredible inaugural partner.

Our first series, "Inside the $1 Trillion Economy", is an exclusive collaboration with authors from Guidance Tamil Nadu. And the first issue will be published this week!

Find all details here.

Curiosity Corner

Your random facts and stories about India and the Indo-European friendship.

This week: The history of India’s defence sector since independence.

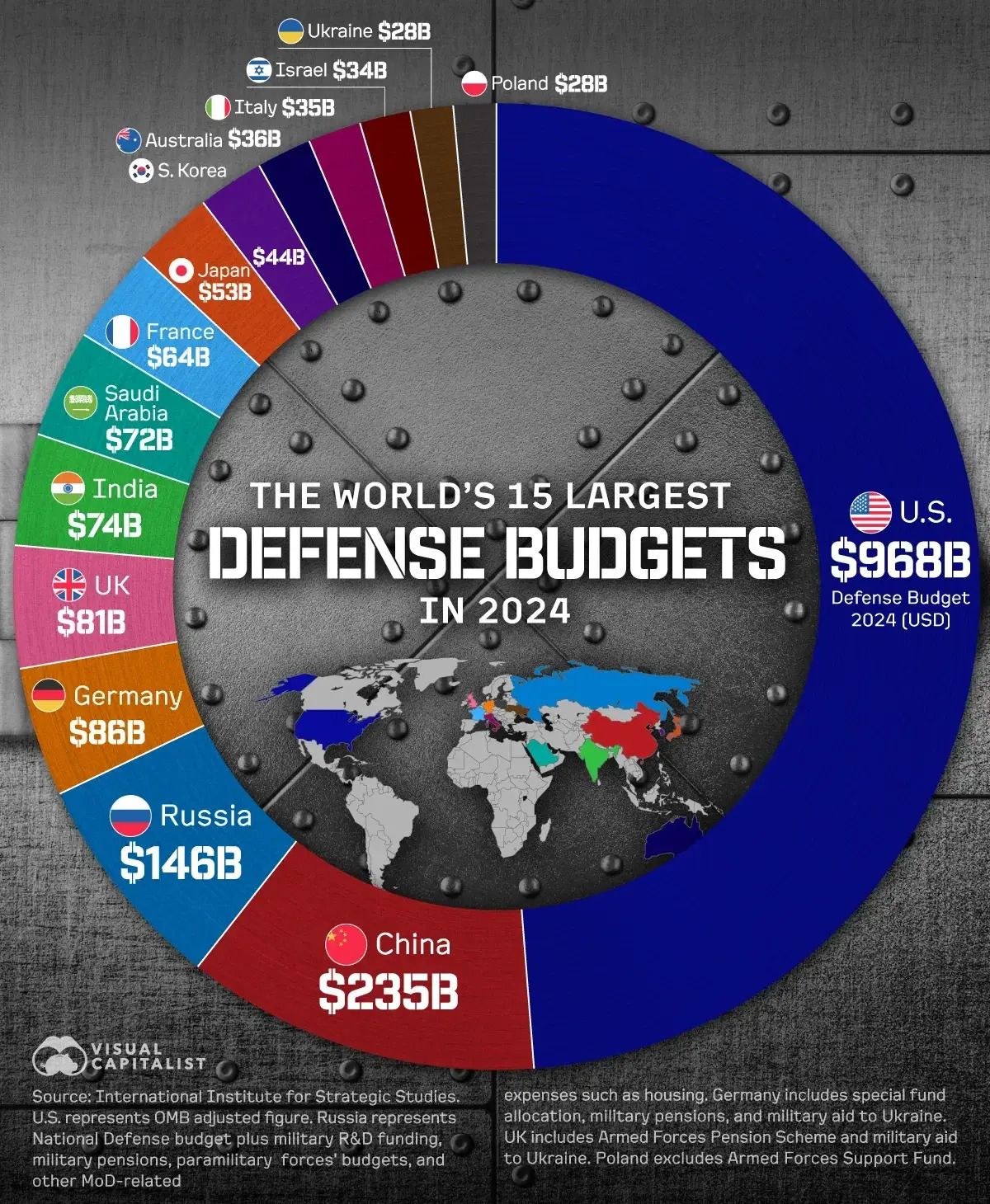

India’s defence sector since independence has evolved from reliance on imports to a strong focus on self-reliance and indigenous manufacturing, marked by the creation of key institutions like DRDO in 1958 and modern initiatives such as Atmanirbhar Bharat.

Public perception of the sector is largely centred on self-defence and national security, with broad support for building a robust and self-sufficient military industry to protect the country. The sector is praised for its role in safeguarding sovereignty. Today, India is among the world’s largest military forces, balancing modernisation, export ambitions, and strategic autonomy.

What was your favourite section this week?

Enjoyed this issue? Share the newsletter with your network.

Whenever you’re ready, here are 3 ways I can help you:

1. Real Estate Services

Whether you're optimising a corporate real estate portfolio, leading a development project, or plan a transaction, I can help you. I support and advise clients on a fractional, interim, or project basis to de-risk and deliver tangible results.

2. Market Entry India & Emerging Markets

As Strategic Advisor to Zinnov, a leading consultancy for globalisation in Tech, I help you set up your organisation’s GCC in India and Emerging Markets.

3. Collaborations & Promotions

I’m a proponent of ecosystems and partnership networks. Whether it’s collaborating on a project, participating in your event or promoting ideas, please reach out.

You can’t get enough or want to catch up on past editions? Follow the link!